Consumer awareness is about making the consumer aware of his/her rights. It is a marketing term which urges the consumer to be aware of products or services. Modern age is the age of industrial revolution. The industries are producing various types of goods for the use of consumers in the daily life. There is a great demand for modern products, particularly among the middle class people of the society. It is noted that most of these products except some luxury goods, are purchased by low income groups of people. The people of these categories want to purchase these goods at a lower price. Consequently, the manufacturers of these products try their best to keep the prices of the products low even though at times compromising with the quality and durability of their products. There is cut throat competition among the manufacturers to produce goods to fulll the increasing market demand. Quality goods are available but they are highly priced and therefore beyond the reach of low income groups. On the other hand, the majority of consumers of this class have no option but to buy these inferior quality products. Besides, the people of this class have little or no knowledge about the consumer protection laws and consumer protection movements. As a result, some manufacturers of consumer products ood the market with poor quality goods to satisfy the ever increasing demand of low income groups.

In order to protect the interest of this class of consumers, the Indian Parliament enacted the Consumer Protection Act, 1986 but it came into force from 1987. Its purpose is to protect consumers against defective goods, unsatisfactory service, unfair trade practices etc. Though the rst consumer movement began in England after the Second World War, a modern declaration about the consumer’s rights was rst made in the United States of America in 1962, from where basic consumer rights were recognised. Ralph Nadar, a consumer activist is considered as the Father of the consumer movement. March 15 is celebrated as the World Consumer Rights Day.

In order to protect the interest of this class of consumers, the Indian Parliament enacted the Consumer Protection Act, 1986 but it came into force from 1987. Its purpose is to protect consumers against defective goods, unsatisfactory service, unfair trade practices etc. Though the rst consumer movement began in England after the Second World War, a modern declaration about the consumer’s rights was rst made in the United States of America in 1962, from where basic consumer rights were recognised. Ralph Nadar, a consumer activist is considered as the Father of the consumer movement. March 15 is celebrated as the World Consumer Rights Day.

The Act applies to all goods and services except those which are expressly excluded by the Central Government by notication. The Indian Consumer Act, 1986 is unique in many respects. In no other country, separate courts and tribunals have been established for deciding consumer disputes. The Consumer Act provides for setting up of quasi-judicial bodies at the District, State and National levels for redressal of consumer disputes. It vests concurrent jurisdiction as enjoyed by the established courts. Its objective is to provide inexpensive and speedy justice to the consumer.

The Act is a social, benet oriented legislation. The ling of complaint under the Consumer Protection Act does not involve engaging the lawyers or rushing to the Consumer Forum for ling the complaint. Alternatively, it can be led by sending the same by registered post to the concerned Forums. The Act provides simple procedures for decisions regarding the cases. For this purpose, it paves way for the establishment of consumer councils at the National level, State level and in the Union Territories for the settlement of consumer disputes and for matters connected therewith-

The Act is a social, benet oriented legislation. The ling of complaint under the Consumer Protection Act does not involve engaging the lawyers or rushing to the Consumer Forum for ling the complaint. Alternatively, it can be led by sending the same by registered post to the concerned Forums. The Act provides simple procedures for decisions regarding the cases. For this purpose, it paves way for the establishment of consumer councils at the National level, State level and in the Union Territories for the settlement of consumer disputes and for matters connected therewith-

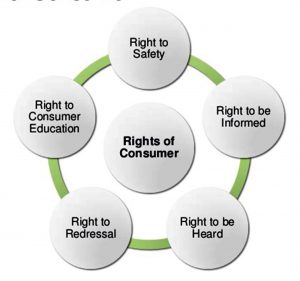

To promote and protect mainly the following rights of consumers:–

1) The right to be protected against marketing of goods which are hazardous to life and property.

2) The right to be informed about the quality, quantity, potency, purity, standard and price of goods to protect the consumer against unfair trade practices.

3) The right to be assured, whenever possible, access to any goods at competitive prices.

4) The right to be heard and to be assured that consumer’s interests will receive due consideration at appropriate forums.

5) The right to seek redressal against unfair trade practices or unscrupulous exploitation of consumers.

6 ) The right to consumer education.

Under Section 2(b) of the Consumer Protection Act, the following persons can le complaint for defects and deciency in goods and services

Under Section 2(b) of the Consumer Protection Act, the following persons can le complaint for defects and deciency in goods and services

a)A consumer

.b) Any voluntary consumer registered under the Companies Act, 1956 or any other law for the time being in force.

c) The Central Government or any State Government.

d) One or more consumer shaving the same interest.

e) Incase of death of a consumer, his/her legal heir or representative.

The complaint should include the following information-

1) Allegation in writing regarding the grievances and facts giving relevant dates, etc.

2) The name, description and address of the complainant and opposite party i.e. respondent.

3) The documents and afdavit in support of allegation.

4) The relief or compensation asked by the complainant.

5) The complaint should be signed by the complainant or his/her authorised agent (may be a lawyer).

6) The complaint can be posted before the concerned forum in person or by post.

The expression ‘consumer’ has been dened in Section 2(1) (d) of the Consumer Protection Act as any person who-

1) buys any goods for consideration which has been paid or promised; partly paid or partly promised, or any system of deferred payment and includes any user of such goods, other than the person who buys such goods for consideration, for resale or for any commercial purpose.

2) ‘hires or avails’ of any services for a consideration which has been paid or promised, or partly paid or partly promised, or under any system of deferred payment and includes any beneciary of such services other than the person. And where such services are availed of the rst-mentioned person, but does not include a person who avails of such services for any commercial purpose.

According to the above denition the following persons are consumers-

1) A person who buys goods fora consideration which has been paid or promised; partly paid or party promised.

2) A person who uses such goods with permission of the buyer, who buys such goods for a consideration paid or promised; partly paid or partly promised.

3) A person who hires or avails of any services for consideration which has been paid or promised; partly paid or partly promised.

4) A person who is a beneciary of such services with the approval of the buyer.

Who is not a consumer?

1) A person who obtains goods for commercial purposes-under section 2(1)(d), a person who obtains goods for resale or for any commercial purpose is not a consumer.

2) A person who offers services free of charge-In respect of services rendered free of charge or under contract of personal services.

What is a consumer dispute?

According to section 2(e), a consumer dispute means a dispute where the person against whom a complaint has been made, denies or disputes the allegations contained in the complaint. Allegations are as follows-

1. Unfair Trade Practice– a’complaint’ is led against the unfair trade practice of the trader as a result of which the complainant has suffered loss or damage. According to section 2(r), ‘unfair trade practice’ means a trade practice in which a trader for the purpose of promoting the sale, use, supply of any goods or for the provision of any service adopts an unfair method or deceptive practice.

2. Restrictive Trade Practice– According to section 2(n), trade practice which tends to bring about manipulation of price or its conditions of delivery or to affect ow of supplies in the market relating to goods or services in such a manner as to impose on the consumers unjustied costs or restrictions and shall include- a) delay beyond agreed to, by a trader in supply of such goods or in providing the services which has led or is likely to lead to rise in the price. b) any trade practice which requires the consumer to buy, hire or avail of any goods or, as the case may be, services as condition precedent to buying, hiring or availing of other goods or services.

3. Defect in Goods- Accordingto section 2(1)(f), ‘defect’ means’ any fault, imperfection or  shortcoming in the quality, quantity, potency, purity or standard which is required to be maintained by or under any law for the time being in force or as is claimed by the trader in any manner whatever in relation to any goods.’ The allegation of defect in goods may be made against a trader or government or public undertakings.

shortcoming in the quality, quantity, potency, purity or standard which is required to be maintained by or under any law for the time being in force or as is claimed by the trader in any manner whatever in relation to any goods.’ The allegation of defect in goods may be made against a trader or government or public undertakings.

4. Deciency in Service– According to Section 2(1)(g), ‘deciency’ means ‘any fault, imperfection, shortcoming or inadequacy to the quality, nature and manner of performance which is required to be maintained by or under any law for the time being in force or has been undertaken to be performed by a person in pursuance of a contract or otherwise in relation to any services.

‘The word ‘service’ means service of any description which is made available to potential user and includes the provision of facilities in connection with banking, nance, insurance, transport, processing, supply of electrical or other energy, boarding or lodging or both, housing construction, entertainment, amusement or the purveying of news or other information, but does not include the rendering of any service free of charge or under a contract of personal service.

Compensations eligible at various Forums and Commissions are:

District Consumer Forum: To claim a compensation upto Rs. 20 Lakhs.

State Commission: For a claim of compensation above Rs. 20 Lakhs and up to Rs.1 Crore.

National Commission: For a claim of compensation above Rs.1 Crore.

Some points regarding ling of complaints:

a) Complaints can be registered within 2 years from the date on which the cause of action has arisen; (But not 3 years as in normal civil claim)

b) Stamp paper is not required for declaration;

c) Complaint can be registered in person by the complainant or through his authorised agent;

d) Services of lawyers are not mandatory.

What are the particulars that should be furnished along with the complaint?

The complaint should contain the following particulars:

a) The name and address of the complainant.

b) The name and address of the Opposite Party/Parties.

c) Date of purchase of goods or service availed.

d) Amount paid for above purpose.

e) Particulars of goods purchased with numbers or details or services availed.

f) Bills, receipts and copies of the connected correspondence, if any.

g) The relief sought for under the Act.

What are the reliefs provided under the Act?

The Act provides the following reliefs:

a) To remove the defects in the goods pointed out.

b) To replace the goods.

c) To return to the complainant the price of the goods.

d) To pay such amount of compensation for the loss, injury suffered by the consumer.

e) To remove the defects or deciency in the service.

f) To discontinue the unfair trade practice or not to repeat it.

g) To withdraw the hazardous goods from being offered for sale.

h) To provide the cost of expenditure incurred by the complaint.

What is the appeal provision?

Appeal Provisions are as follows:

a) Aggrieved by the orders issued by District Consumer Redressal Forum, appeal petition may be led before State Consumer Redressal Commission, within 30 days from the date of receipt of the order. (Under section 15)

b) Aggrieved by the orders issued by the State Consumer Dispute Redressal Commission, appeal petition may be led before the National Consumer Dispute Redressal Commission within 30 days from the date of receipt of the orders. (under section 19)

c) Aggrieved by the orders issued by the National Consumer Dispute Redressal Commission, appeal petition may beled before the Supreme Court of India within 30 days from the date of receipt of the orders.

N.B. A limit of 90 days has been xed for deciding the appeal by the Commission from the rst date of hearing (rule 8). The orders of the National Commission shall be communicated to the parties free of charge (rule 9).

Case Law – Indian Airlines vs. Nripendra Kumar Bhattacharya

In this case, Indian Airlines increased fares but failed to contact and notify passengers in advance regarding the enhancement of fares to journey undertaken after specied date. It led to inconvenience and mental agony of passengers. It amounted to deciency in service, and the airline was therefore held liable to pay compensation.

Case Law – Indian Airlines vs. Prakrithi Shetty

There was delay in transporting of baggage of the plaintiff. She suffered loss due to pilferage and theft from baggage. The baggage was opened in presence of airline authorities and they were found to be tampered with and the jewel box, some clothes, a pair of sandals and camera was found missing. The evidence showed that airlines staff had tampered with the suitcase, broke open the lock and the zip of another baggage was torn which has resulted in pilferage. The Court held that the Airline was guilty of ‘deciency’ in service and liable to pay compensation.